Social Security will reward those workers who delay retirement. However, if you file at 60, it could cause financial difficulties if you have not saved enough. In fact, there are some workers who have neglected their savings accounts and investments.

Therefore, those seniors who file at 62 should know that there will be a 30% reduction. Perhaps, you have enough money now but you will be on a shoestring budget.

Inflation could make this situation worsen, so try to delay the age you file at least until you reach Full Retirement Age. That is 67 if you were born in 1960 or later. The normal retirement age allows you to get 100% of your benefits.

HOW MUCH CAN A RETIREE GET AT 62 IN 2023?

This is a very tricky question because it will depend on your work history and earnings. Of course, you already know that at 62 you will get a 30% reduction. Anyway, the Social Security Administration has revealed that the average check is $1,848 in 2023.

Imagine you got a 30% reduction at 62 and that the full amount is $1,848 at 67. If you did so, you could get a reduction worth $554.40. Hence, your payment as a retiree will be $1,293.60 at 62.

If you have been a high earner all your life, this could be a different story. Those workers who have earned the taxable maximum for at least 35 can get $2,572 at 62 in 2023. Bear in mind that the taxable maximum is $160,200 in 2023, which is not something easy to achieve.

While that person could have earned a retirement check worth $4,555 had they filed at the age of 70. Anyhow, it is your decision and you should reflect on it to think what suits you best. Early filing means getting more checks and having more free time.

CAN I SEE A SOCIAL SECURITY FORECAST OF MY FUTURE RETIREMENT CHECKS?

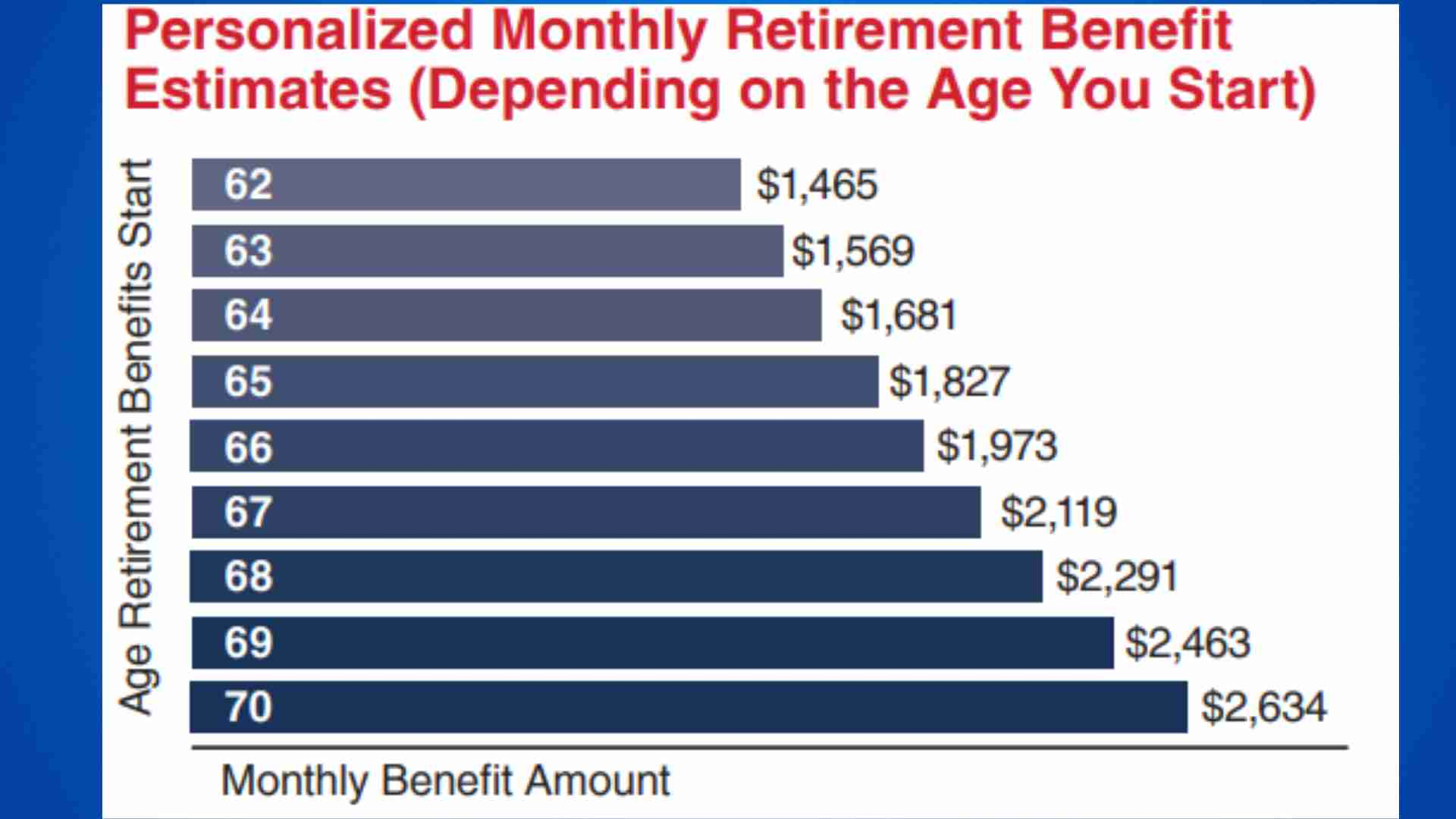

As a matter of fact, you can see the different amounts at different ages. All you have to do is download a Social Security statement. There, you will be able to see the full amount of your benefit at 62.

Apart from that, you will be able to compare your checks from 62 through 70. By doing so, you will be able to get a much better and more realistic idea of your future retirement benefits.

What is more, you will be able to see if you can qualify for disability benefits, (Social Security Disability Insurance). Not only that, survivors benefits eligibility and amounts will be shown too.

Retirement is not something you can do on the spur of the moment. It is of vital importance that you take into account medical expenses. The older you are, the more likely to need medical services.

Keeping up with the pace of inflation is challenging. Even if Social Security updates benefits every year with the COLA increase, you may lose buying power. The expected average retirement check will be $1,907 in 2024, up from $1,848. So, at 62 you could get $1,334.90 if you got a 30% reduction in 2024.