Planning can help you succeed, and the IRS knows it. There are millions of Americans who must file a 2023 tax return in 2024. That is why it is of vital importance to get ready in advance.

If you start getting ready 1 day before the deadline, you may forget things or submit an inaccurate tax return. Therefore, the IRS recommends gathering all the necessary documents and information to file.

As the new tax season starts on January 29 and finishes on April 15, 2024, in most states, you still have about 20 days to prepare everything carefully, and without rushing. Here are some tax records you will need.

THE IRS RECOMMENDS GATHERING THESE THINGS

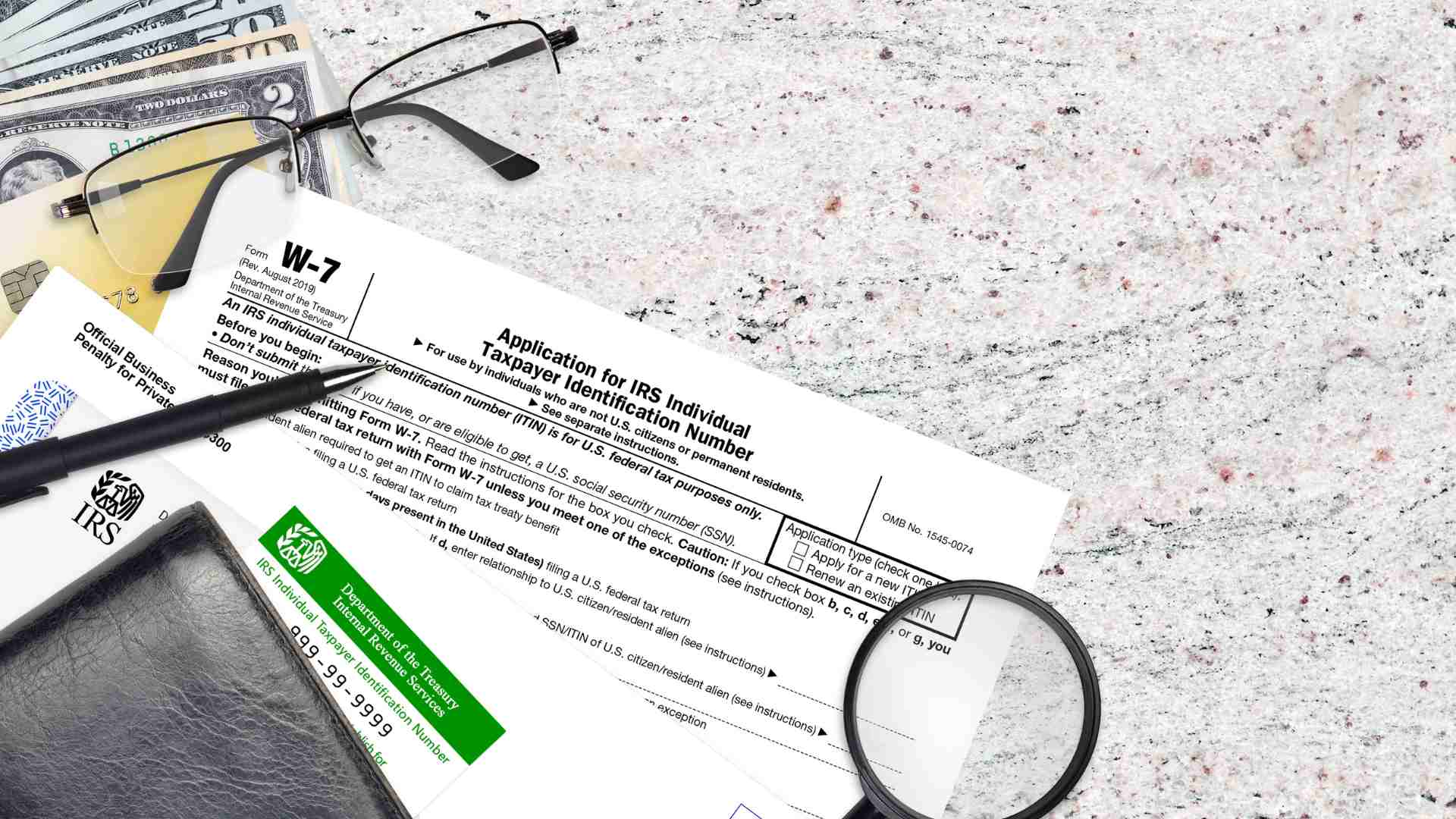

First and foremost, make sure you have your ITIN. ITIN stands for Individual Taxpayer Identification Number. If you file jointly, prepare your ITIN and your spouse’s as well.

What is more, you will need your Social Security Number, which is commonly known as the SSN. If you are a parent and have recently adopted a child, do not forget to gather the Adoption Identification Number.

Apart from that, you will need to have your IP PIN. That is an Identity Protection Personal Identification Number. Bear in mind that if your tax return is not accurate, the IRS will take longer to process your tax refund.

Once the IRS finds out there is a mistake in your tax return, they will mail you about this issue. In order to avoid this, start planning your documents and information as soon as possible.

ESSENTIAL TIPS FROM THE INTERNAL REVENUE SERVICE

Some taxpayers do not report all their income says the IRS. This is a common mistake because people do not wait until they have all their income-related documents to file their tax returns.

If you have not received all your income forms, it is best to put off filing until you get them all. Whether you get Forms 1099 from other payers or a bank, you must report everything.

Those taxpayers who receive pensions, dividends, unemployment compensation, annuities, or retirement plan distributions must wait for the various Form 1099 to arrive before they file their 2023 tax return claims the IRS.

The last thing the IRS recommends doing is to file their 2023 tax return electronically. Do not forget to ask for a direct deposit. This will be the fastest and easiest way to collect all your money from your tax refund. Paper returns can take too long and you may need this money.