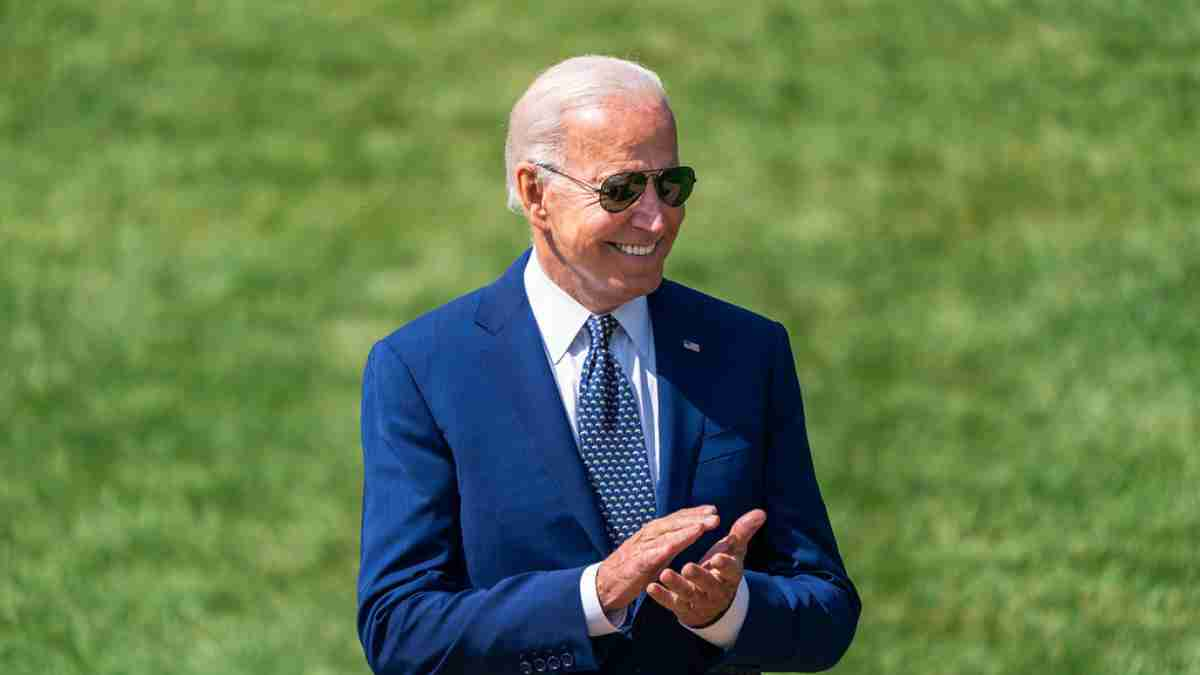

Exciting news is on the horizon for student loan borrowers! This December, thanks to President Joe Biden, two additional debt forgiveness options will be available, as reported by Forbes.

While the fate of Biden’s Saving on a Valuable Education (SAVE) plan is currently entangled in court challenges, borrowers will soon have the chance to explore two other income-driven repayment plans. These plans are set to open next month, offering a path to reduce or even completely eliminate student debt.

Biden Administration Revives PAYE and ICR Plans Amid SAVE Plan Uncertainty

Although the legality of the SAVE plan remains uncertain, it has already made significant impacts. By reducing monthly payments and eliminating high interest rates for millions, it has provided full student loan forgiveness after a duration of 10 to 25 years of consistent payments. However, when the SAVE plan was introduced, it unfortunately phased out new enrollments in the older plans: Pay-As-You-Earn (PAYE) and Income-Contingent Repayment (ICR).

In light of the SAVE plan’s uncertain future, Biden’s Department of Education (DOE) has decided to reinstate the opportunity for borrowers to enroll in the PAYE and ICR plans. This move opens up more options for those seeking manageable ways to tackle their student debt.

- PAYE (Pay-As-You-Earn): Tailored for those with financial need, offering lower monthly payments.

- ICR (Income-Contingent Repayment): Provides flexibility with payments based on income and family size.

These plans not only offer relief but also a renewed sense of hope for those striving to overcome their student loan challenges.

Under the Biden Administration, the landscape of student loan repayment plans saw significant changes. While the PAYE and ICR plans were in existence before, they were eventually merged into the broader SAVE initiative. This was confirmed by Alex Beene, a financial literacy instructor at the University of Tennessee at Martin, during an interview with Newsweek.

The Evolution of Student Loan Repayment Plans

Beene explained that with the ongoing suspension of the SAVE plan, as it navigates the complexities of the court system, the administration is strategizing to bring back the previous plans. This move aims to support students who would have benefited from these options.

Biden’s Efforts in Student Loan Forgiveness

During President Biden’s tenure, the Department of Education made a substantial impact by providing $175 billion in student loan forgiveness, benefiting approximately 5 million individuals.

Ensuring Loan Repayment Options

According to a spokesperson from the Department of Education, as they continue to defend the SAVE plan in legal proceedings, proactive measures are being taken to ensure borrowers have viable options for loan repayment. This is particularly crucial for those pursuing Public Service Loan Forgiveness while litigation is ongoing.

The interim final rule plays a crucial role in ensuring that the Department fulfills its statutory duties under the Higher Education Act. This rule enables borrowers to make payments through an income-contingent repayment plan by implementing a temporary solution. This solution reopens enrollment for two specific repayment plans: Income Contingent Repayment (ICR) and Pay As You Earn (PAYE). Further details will be shared as the Department prepares to enroll new borrowers in these plans.